- The current supply and demand trend in Brooklyn real estate has the borough at a slight stalemate, with supply sitting at 3390 and no remarkable changes expected in the short run.

- Buyers may have to make peace with existing options as further variety is not likely before the next listing cycle, expected only in February or March.

- Brooklyn's disappointing week sees supply down by 33% in the short run, leaving buyers waiting for discounts that may already be in the rearview mirror.

Gather 'round Brooklynites and others!

Let's approach this week's market numbers with the insight and expertise from years of experience in NYC real estate and some great insights from our friends at Urbandigs. For those who thrive on data, let's delve in and make sense of this week's key metrics.

I love seeing numbers to make sense of what I see on the ground these days.

What’s the story with supply?

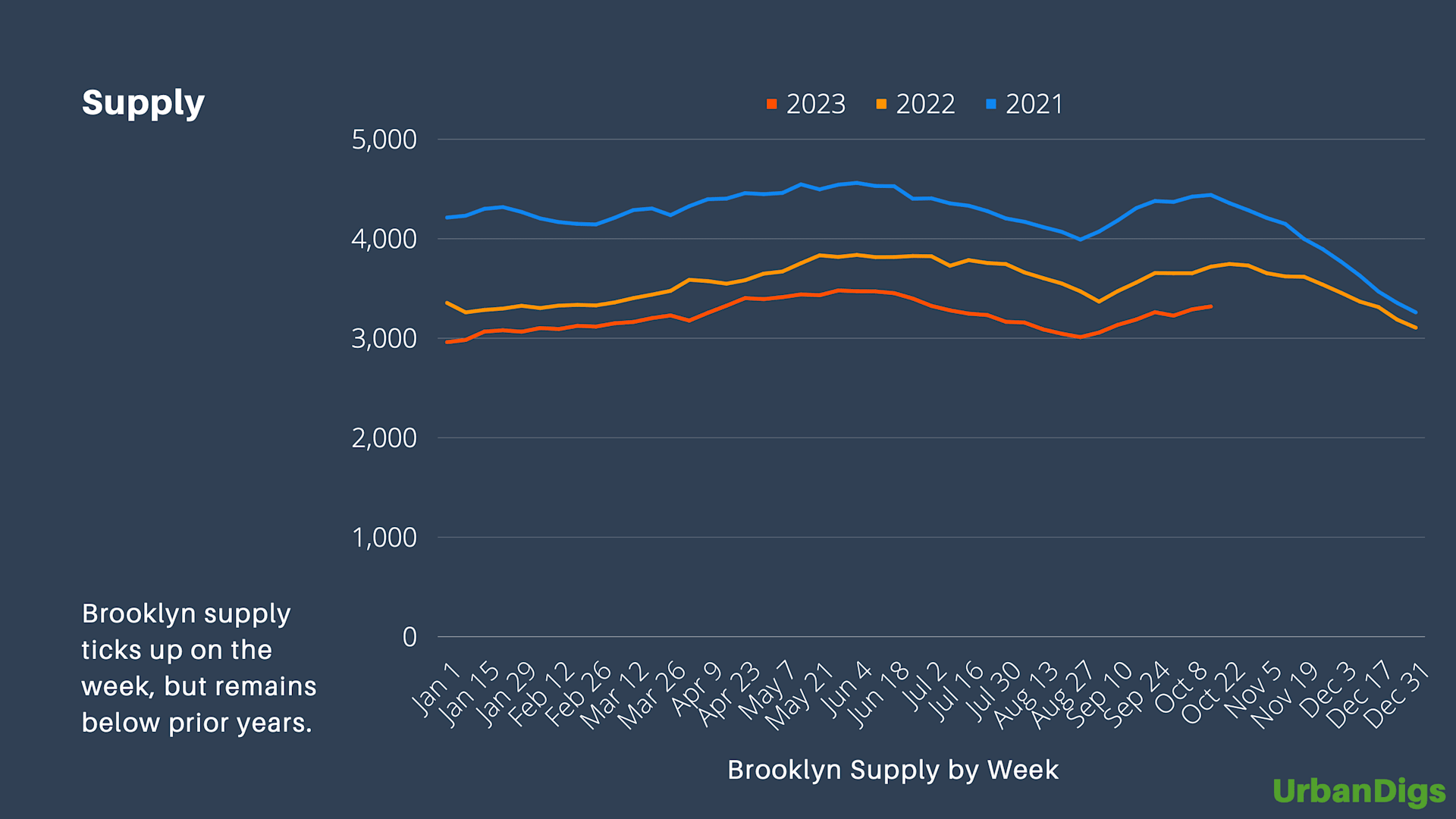

Brooklyn supply was at a lukewarm 3390 this week, performing the most dedicated reenactment of Groundhog Day we've seen thus far - it has not really moved up or down in a few weeks now. It's ticking along like clockwork, following its own seasonal patterns. There's been no drama, no fireworks, just a predictable flow of properties ebbing and rolling in line with the naturally occurring calendar events.

Apparently, Brooklyn didn't get the memo about the inventory surge we were expecting.

And what is happening with demand?

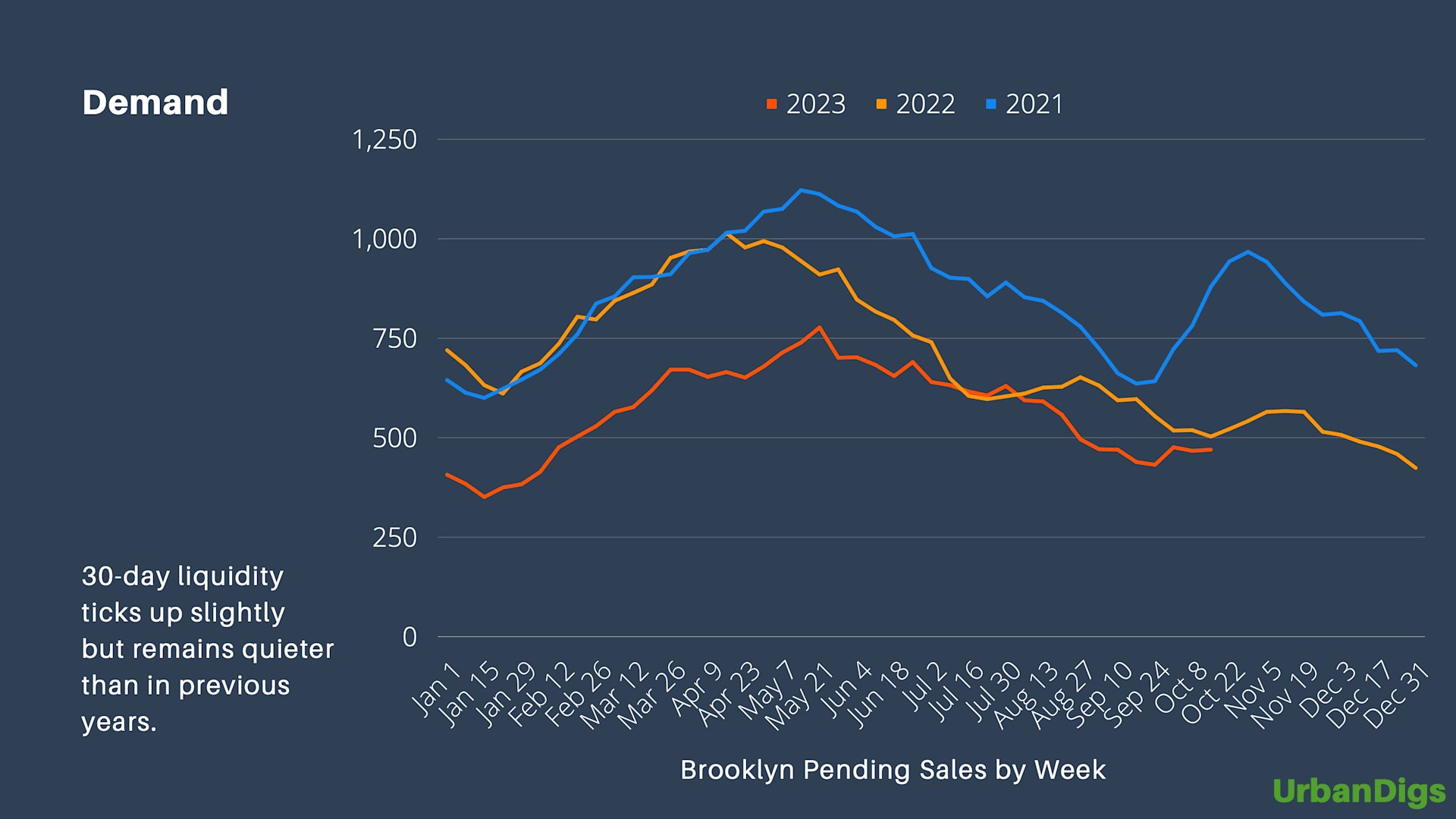

Now, strap in; let's check out Brooklyn's demand dynamics. It's like watching paint dry in slow motion - 470 contracts have been signed in the last 30 days. We're up by 1% from last week (slightly less exciting than it sounds). It seems Brooklyn's busy season has been caught in an economy being forced to slow down.

Let us shed a tiny tear for all the buyers in the wings, eagerly awaiting more options. Sorry to be the bearer of bad news, but this might be as good as it gets until the listings bloom again come February or March.

But hey! It's a buyer's market, so maybe it's time for a little ambition – go ahead, pull that trigger.

Let's flip over to our weekly numbers.

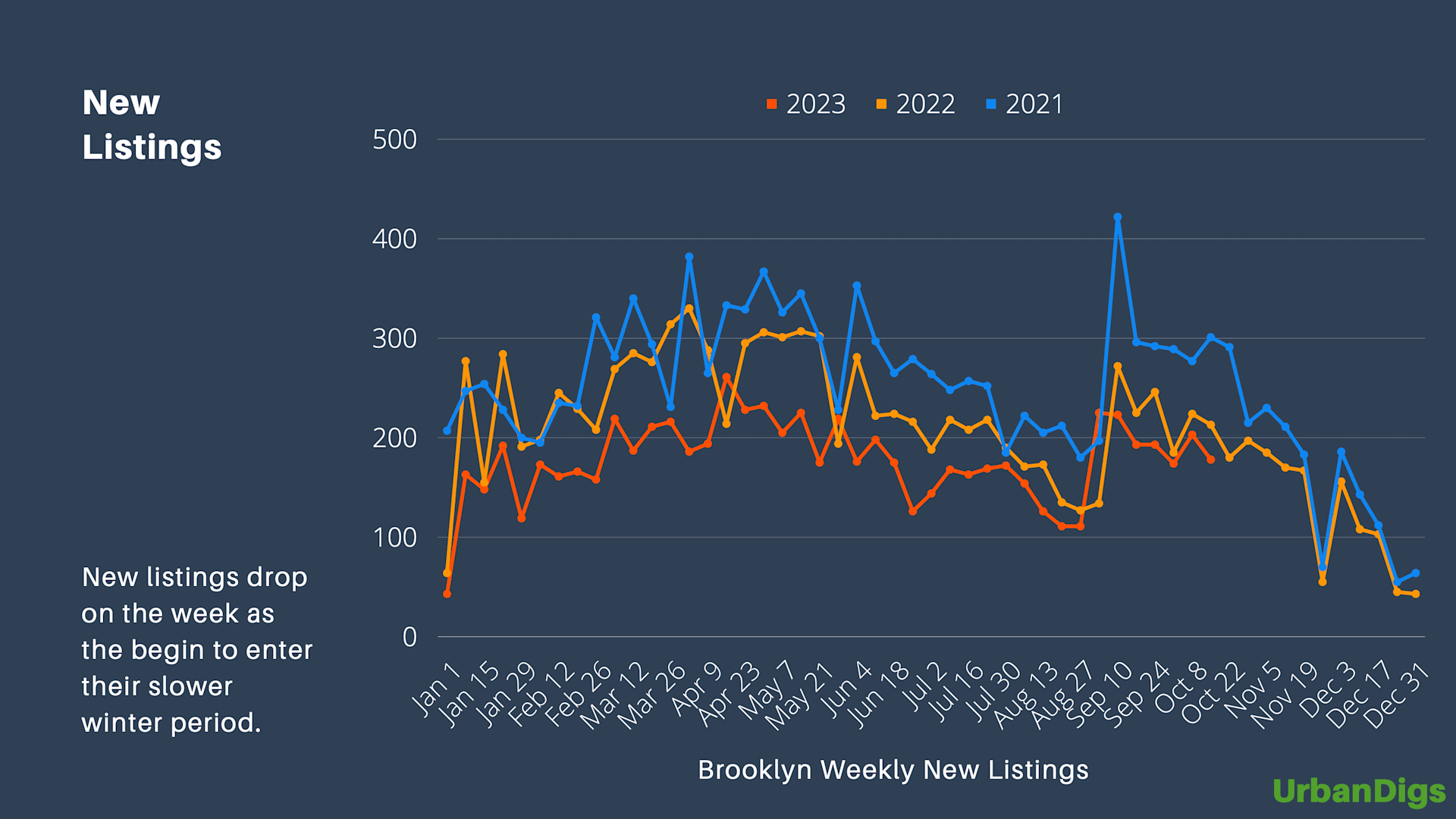

Supply is a bit of a tongue-twister – down 33% on a weekly level, yet still flourishing in the grander scheme. In friendly terms, new additions are joining at a steady rate, but their departure is even more leisurely.

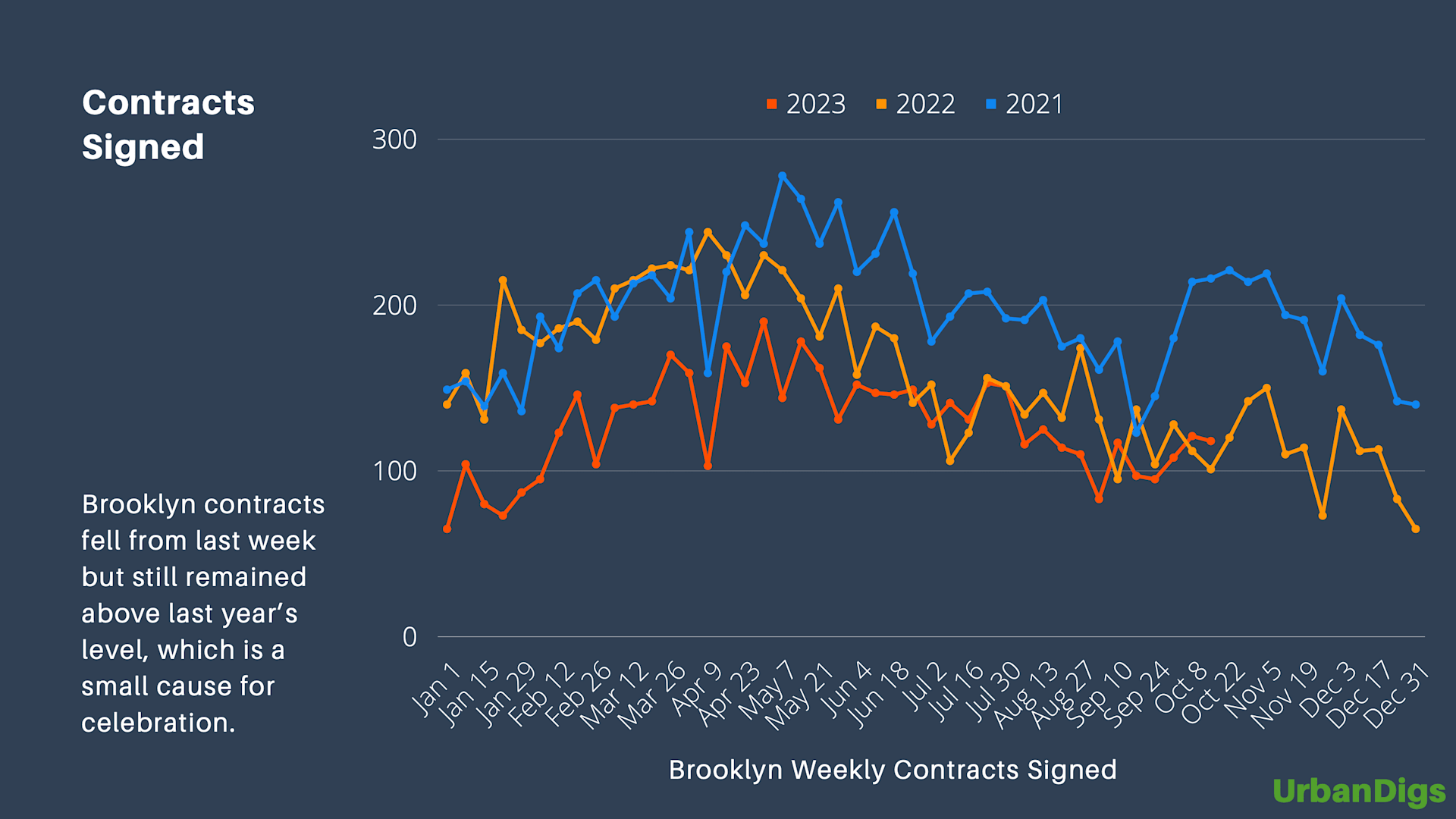

Meanwhile, on the other side of the coin, we've got 118 deals signed, which doesn't look all that bad. It's all relative, though: last fall wasn't our best performance, and if you want to know the discounts on those contracts, I hate to break it to you, but we're fresh out of crystal balls. We'll have to wait until February or March to get the data and share the discount story then.

Bottom line:

If "timing the market" is your game, the time to strike might be now. By the time the discounts become apparent in the rearview mirror, the prime buying window might be long gone. So collect your courage, and get out there making offers. You might be surprised who takes it.

That's the lighthearted lowdown for this week. I know, I know, it's a whirlwind of numbers and trends, but as the old saying goes, knowledge is power, and I'm thrilled to be your power provider.