Listen up, New Yorkers! The internet's buzzing with rumors about a "new" unfair tax targeting mortgage borrowers with high credit scores. Some folks are even saying you should tank your credit score for a better deal. But hold your horses, let's sort out the truth from the gossip.

First things first, let me be clear: having a lower credit score will NOT land you a better mortgage rate. Even if your nephew sent you a headline reading "620 FICO SCORE GETS A 1.75% FEE DISCOUNT" and "740 FICO SCORE PAYS 1% FEE." So, why the confusion?

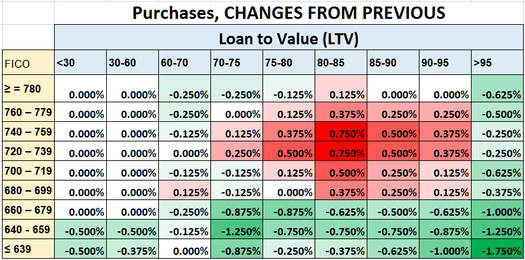

It's all about changes to Loan Level Price Adjustments (LLPAs) by Fannie Mae and Freddie Mac (the "agencies") - the big shots that guarantee most new mortgages. LLPAs depend on factors like your credit score and loan-to-value ratio, and they've been adjusted a few times. This particular update was announced back in January.

Wait, January? Why's it news now?

Well, truth be told, we've mentioned it before. Folks are just getting mixed up with Fannie and Freddie's "delivery dates" concept. Fee and guideline changes usually apply to loans "delivered" to the agencies - which happens a few weeks or more after closing.

Considering loans are quoted and locked for about a month, lenders began applying these changes weeks, even months ago for loans with longer lock periods, especially those due on or after May 1st, 2023.

So, are low credit borrowers enjoying discounts while high credit borrowers pay extra?

Not quite! Here's where things get twisted. Remember, we're not judging whether this is good or bad, just stating the facts.

LLPAs are changing to favor lower credit scores and charge more for higher credit scores (in many cases). But folks are confusing the CHANGE with the ACTUAL cost.

So, low credit borrowers still pay more than high credit borrowers? The gap's just smaller now?

Bingo! Putting personal opinions aside, the change tweaks the existing fee structure to help those with lower credit scores and charge more for higher credit scores. But don't think for a second that a lower credit score will net you a lower fee. Keep making those credit card payments, folks!

Craving some visuals? Let's dive into the changes that got everyone talking. The table below shows the DIFFERENCES in LLPAs before and after the change. RED = rising costs. GREEN = falling costs.